“Reciprocal” is quite the doublespeak when Trump uses it as a descriptor of the tariffs he announced yesterday, in the Rose Garden.

A “reciprocal” tariff is supposed to be a tax placed on imports from another country because that country places a tax on its imports from your country. Thinking about trade relationships in terms of tariff-setting wars is not very useful though; it is totally possible to be content or even happy with a trade relationship regardless of tariffs, which we’ll get into a bit more below.

That’s kinda beside the point though, because…

These are not reciprocal tariffs. They are just new, very high tariffs.

In addition to being very high, this latest set of tariffs is practically incomprehensible. We’ll learn more (hopefully!) in the coming days, but for now, let’s just get right into it:

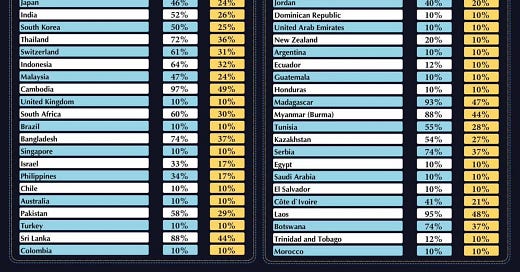

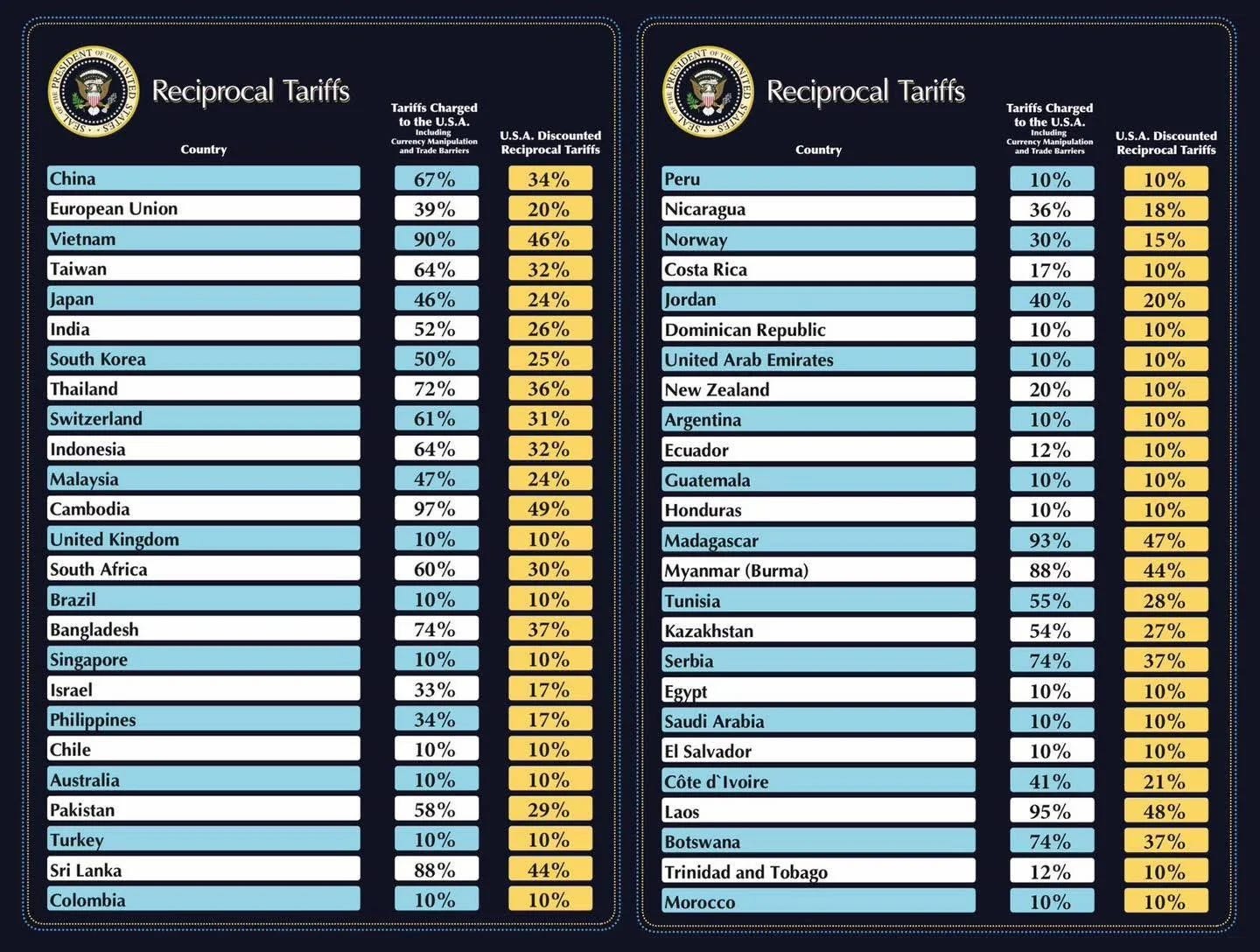

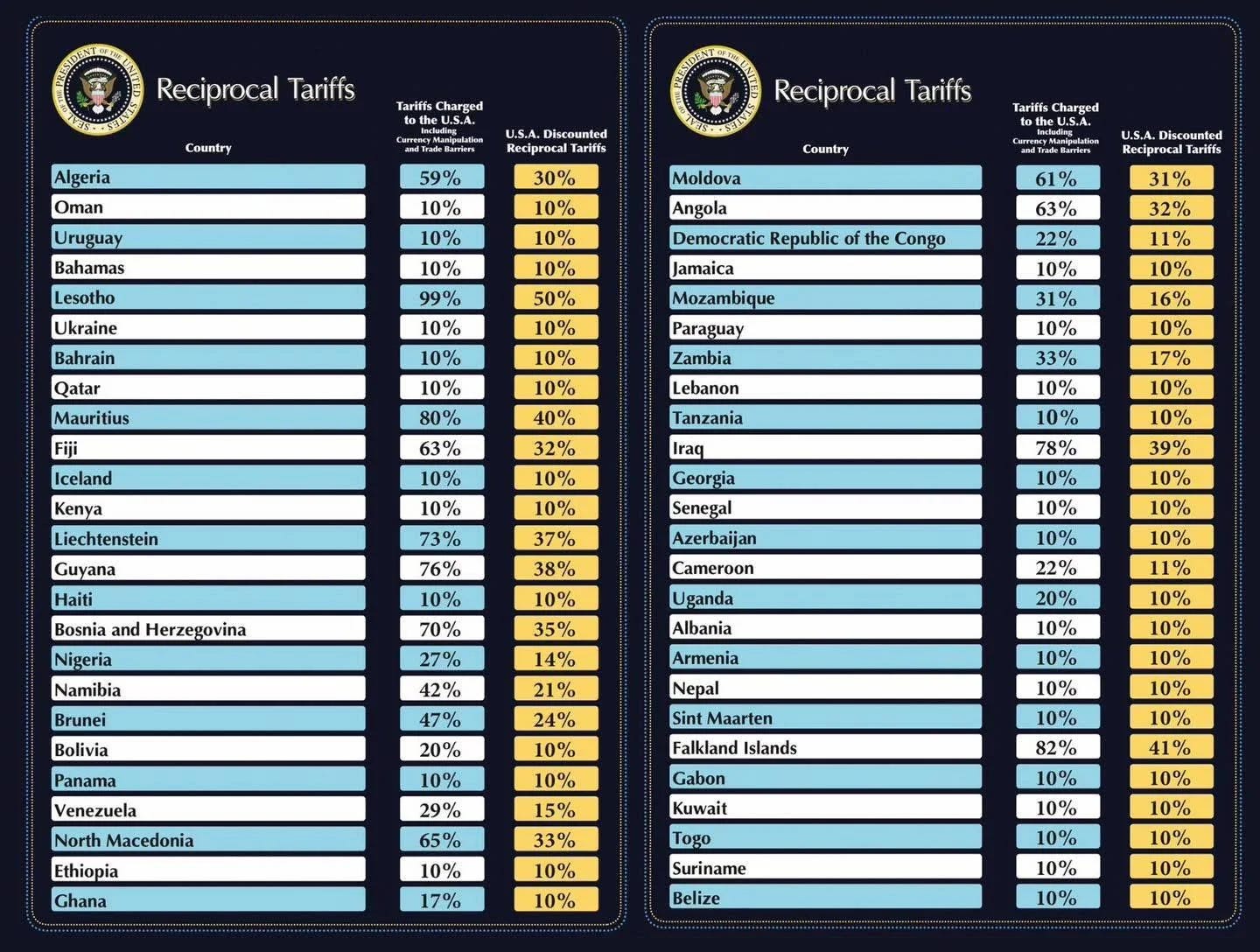

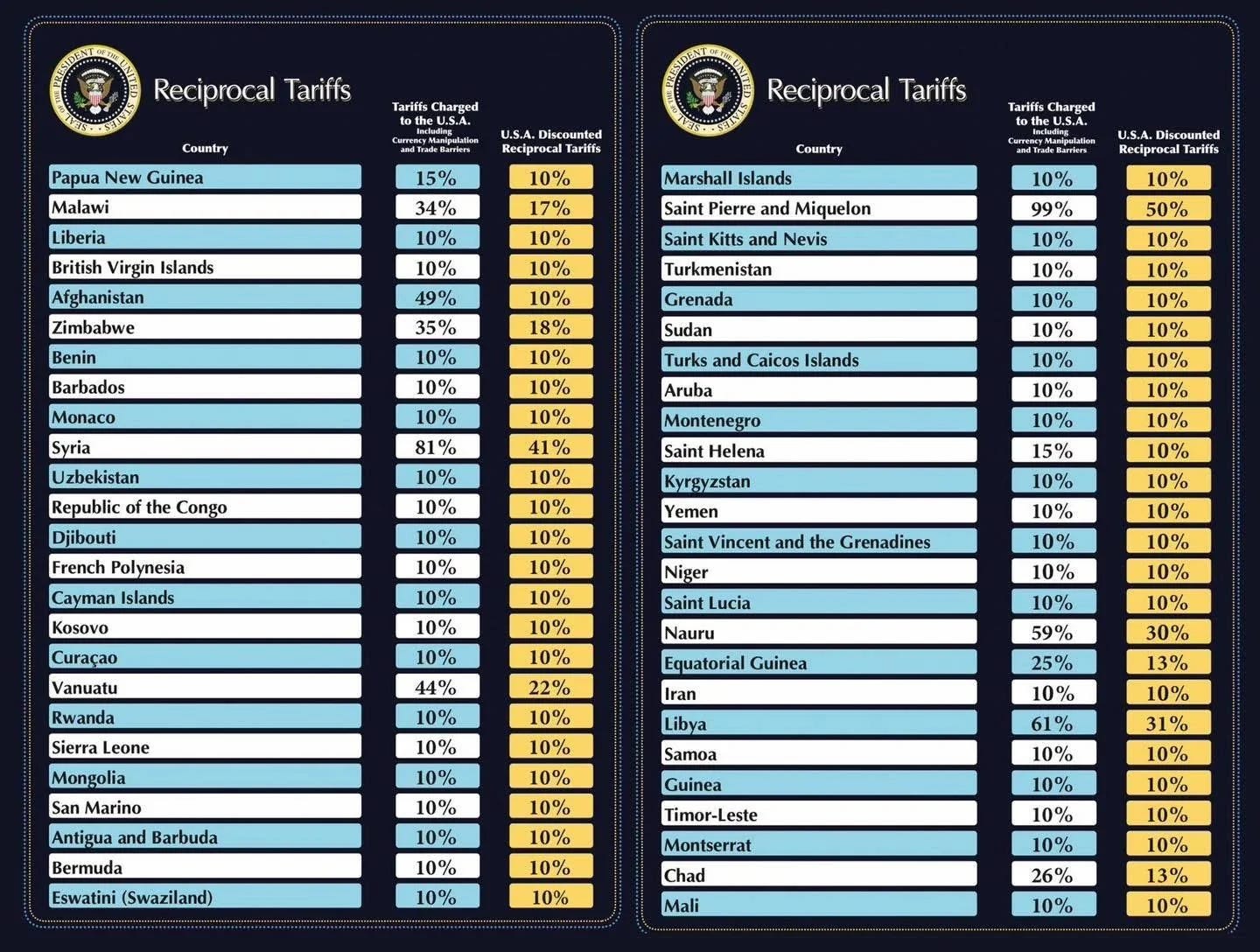

Today in the Rose Garden, Trump presented a series of charts that listed most (but not all) nations, a claimed tariff rate that those nations supposedly apply to US goods, and a new “reciprocal” tariff rate that the US will now apply to imports from each country. There is a base 10% “reciprocal” tariff applied to every country on the list. Countries that the Trump admin is claiming apply higher tariffs to goods from the US are punished with higher “reciprocal” tariffs, which are more-or-less about half of the claimed tariff rate. Here’s a list. Here are the charts:

The big BIG problem is that those claimed tariff rates are totally bogus!

That claimed tariff column is absolutely, 100%, a lie. And, it’s a stupid lie. It’s not even based on tariffs at all!

Instead, the Trump admin is using trade imbalances to set the new tariff rates. The new, so-called “reciprocal” tariff is half of the “claimed tariff.” The “claimed tariff” rate is simply the size of the trade deficit we have with that country divided by the total cost of goods the US imports from that country. This was not explained by the Trump admin. Instead, a bunch of people on the internet noticed. That is a symptom of a deeply sick government.

Not to mention, no nation on the list has a “claimed tariff” of <10%, even if we have a trade surplus with the country.

Let me repeat: these so-called “reciprocal” tariffs are not structured to counter tariffs from other countries. The tariffs other countries place on US goods don’t factor into the equation at all!

In fact, with this formula, countries that levy no or very low tariffs on imported goods from the US just had very high so-called “reciprocal” tariffs placed on them simply because we have a trade deficit with that country. South Korea, for instance, with whom we ostensibly have a trade agreement, will now suffer 25% tariffs on their exports to the US. Wait, let me clarify—South Korea will suffer because their goods will be more difficult to sell in the US. Their goods will be more difficult to sell because they will be more expensive for American consumers. That’s right—no matter what Trump says, that’s how tariffs work: the importer pays the tariff tax.

But wait, aren’t trade deficits bad? Well, no, trade deficits are not bad by default. There might be very good reasons why a trade deficit exists, yet the US still benefits from the trading relationship.

For example, take Madagascar. Trump announced a 47% tariff on Madagascar, one of the highest in the list. They import very little from the US. Madagascar is a very poor country, and US goods are expensive. Why is there a trade deficit? Even though they don’t buy much from us, we get clothing, minerals, and vanilla. Vanilla is Madagascar’s largest export overall (as of 2021), and it’s popular in the US. We import it because US consumers want to buy it. It has nothing to do with whether or not Madagascar buys things from us.

Clothing and minerals often come from poor countries because the cheap labor keeps the prices low. You’ll notice that Southeast Asian countries like Cambodia, Vietnam, and Bangladesh have also been “awarded” high tariffs based on our trade deficit with them. Yet, I’m sure many American consumers would happily keep their cheap clothings and other textiles even if US companies don’t have much market share in those countries. Again, many US goods are just too expensive for these poor nations.

You can check out bilateral trade relationships further here, at the WTO: https://ttd.wto.org/en/analysis/bilateral-trade-relations?member1=&member2=

Some of the highest tariffs Trump announced are on very poor countries. By using trade imbalance to set the tariff rates, the Trump admin is differentially hurting developing countries.

Here’s a sortable chart of every country (and some non-countries, oddly enough) for which Trump claimed tariffs of >10% on imports from the US. As I said above, this is not true. I’ve initially sorted by the size of the so-called “reciprocal” tariff that Trump placed in response to the bogus claimed tariff, but in a browser (probably not from your email) you can sort by any column. There are multiple pages.

The immediate takeaway I get from this is that the biggest tariffs were levied against some pretty poor countries!

For comparison, the US GDP per capita is $74,578. The measure of GDP per capita I’m using is with “purchasing power parity,” which basically means it accounts for different standards of living.

Only three countries have a lower GDP per capita than the Democratic Republic of the Congo, which has the lowest GDP in the list: Burundi, the Central African Republic, and Somalia. Burundi and the CAR are “only” getting the 10% “base reciprocal” tariff; I didn’t see Somalia on the list. I have no idea why it wouldn’t be included. Certainly other countries facing poverty, internal conflict, etc. are included.

It’s probably a fool’s errand to spend too much time thinking about the “why.”

The chart also includes the actual tariff rates that these countries apply to imports from other countries. You’ll see that the actual tariff rates are nowhere near the claimed tariff rates. And no, that’s not because these countries oddly apply high tariffs only to the US. They don’t. It’s just that the Trump admin is lying.

If you sort by tariff rate, you’ll note that mainly poor countries have relatively high tariff rates. Let that sink in for a sec.

For poor countries, the tariffs act as a primary source of government revenue. A poor country may not have residents with income on which to apply income taxes or the central administration to collect those taxes. A poor country may also levy tariffs to protect a nascent domestic industry (and richer nations may allow them to through programs like the US’s former generalized system of preferences, see below).

It’s a tough problem, because tariffs simply do not provide the income required to finance domestic infrastructure that supports economic growth, and without allowances from richer countries, the high tariffs can stifle growth by limiting access to the global market.

I mentioned a program to help developing countries. Until the end of 2020, when the program expired, the US had an official policy to limit tariffs on imports from developing countries in order to help their small domestic industries grow. This is the “Generalized System of Preferences.” Many of the countries on which Trump levied so-called “reciprocal” tariffs of greater than the (new) 10% base were on the list of countries eligible for preferential trade treatment. This program was meant to promote US values in developing countries: “in affording worker rights to their people, in enforcing intellectual property rights, and in supporting the rule of law.” The program has not yet been renewed by Congress.

I didn’t bother to put together a complete list of countries left out because I'm not even sure what they think a “nation” is, based on their inclusion of Reunion (France), the Falkland Islands (United Kingdom), and so on. The Heard and McDonald Islands (Australia) were listed separately, even though they are only home to penguins! The parliamentary representative David Smith of Norfolk Island (Australia), which was also listed separately, asked “Have the Americans just got confused about Norfolk Island, not realising it’s actually part of Australia?”

(The Trump admin even listed Taiwan as a “nation,” which is incredibly based, but I’m guessing China is just assuming it was done out of stupidity—not that China didn’t notice or won’t forget, of course.)

Canada and Mexico were left off of the list, but remember—these are only the “reciprocal” tariffs. They are still getting hit with the auto tariffs that hit today, and apply to everyone. There are already global tariffs on steel and aluminum. And China’s 34% “reciprocal” tariff is on top of the 20% already levied this year. See the NYT’s tariff timeline. Don’t feel bad if you’re confused. Everyone is. I would not be surprised if I got something mixed up in this post. We’re all doing our best.

It’s worth noting that Russia and North Korea didn’t make the list. Supposedly this is because we already have so many sanctions on them, but, like, Iran is on the list, so ¯\_(ツ)_/¯.

With these haphazard, deeply unserious tariffs, Trump dropped the equivalent of a strategic nuke on the world economy, all dressed up in a clown nose and wig. Let’s hope the radiation doesn’t linger for too long.

Post-email edit: I should have linked this NYT column from last year: The Cost of Protectionism Will Be Paid by the World’s Poorest

Well, this is a very excellent presentation. Sick nation indeed. Tactical nuke in the world economy for sure. Who is advising him? Do they understand the consequences? This is going to destabilize the world economy.

Does anybody in the current administration know what they are doing?

¯\_(ツ)_/¯.

Senator Chris Murphy posted a clear explanation of what Trump is doing with tariffs. It took him 11 posts on Blue Sky which I consolidated into one document with no changes.